We talk with a lot of manufacturing leaders, and we’ve noticed the same challenges come up again and again in Sales and Operations Planning. Maybe these sound familiar:

- Building a “forecast” by taking one big order from a customer and dividing it by 12 months, generating an inaccurate or obsolete forecast causing unnecessary inventory build-up.

- Finding out that sales and operations “leaned forward” on procurement of inventory to meet lead time on a large upcoming order, only to find out it was delayed or cancelled, uselessly tying up cash.

- Planning production based on only what’s already in the order backlog, instead of aligning with true future demand, causing extended lead times and potential lost sales.

- Focusing on unit volumes only, and not factoring in product mix, seasonality, or margin impact, unnecessarily constraining available manufacturing capacity to handle spikes in demand.

These kinds of shortcuts feel efficient in the moment, but they often lead to missed targets, stockouts, reduction of cash, increase in inventory and misalignment between sales, operations and finance.

These problems and more were the focus of the new Sip Club, hosted by Expandable Software and MIE Solutions (subsidiaries of Mirador Software Group) on September 18th, 2025. Once again, industry leaders gathered to discuss issues and share insights on their solutions, with David Gavlik, Chief Financial Officer of BSC Industries, as the featured guest.

So, what is sales and operations planning?

Sales and Operations Planning, or the S&OP Process, is a process by which a company consolidates forecast information from the various functions of the enterprise in a structured manner to prepare a business plan for the company and communicate and establish coordinated priorities for all parts of the organization.

“Sales and operations planning is a widely used, effective tool for gaining a greater degree of control over [a] company’s operations. Though the use of this tool, a company can coordinate the actions of each functional area through consistent, frequent links between the business plan and each department’s operations by

- Orchestrating communications

- Developing a realistic plan capable of achieving company objectives

- Ensuring that each business decision is made with a deliberate view of its impact on the entire organization

- Ensuring that purchasing is buying the correct items, manufacturing has the capacity to make items, and finance can pay for and forecast results, all in an effort to ensure customer demand is met.

“This dynamic process enables a company’s sales and marketing groups to carefully coordinate the impact of market demand with departments such as manufacturing, engineering and finance. The net result is a dramatically increased ability to anticipate changes in customer needs.” [1]

All companies perform this process in some sort of manner (though some are very informal) but if not organized and cross-functional, it can lead to incorrect, costly decisions.

Who needs to be involved in sales and operations planning?

The short answer is any function in the company that is involved with selling, producing and delivering products to customers. They include:

- Marketing: Providing input regarding programs and company initiatives to promote various product lines and programs to influence future customer buying behavior.

- Sales: The direct interface to the customer and product demand

- Purchasing: To ensure they have the information needed to procure inventory in a timely fashion.

- Operations: To ensure they have capacity and plans in place to handle upcoming customer needs.

- Finance: Sometimes forgotten in this process, finance is the gatekeeper in challenging assumptions, monitoring cash flow, and updating financial projections and the impact to gross margin and overall profitability.

What are some typical S&OP failures?

- Inventory buildup – With inaccurate or incomplete forecasts and being unable to react quickly enough to changing demand, inventories can increase dramatically.

- Tying up available cash – “Leaning forward” on inventory purchases (aggressive forecasting) for large orders that are delayed or cancelled uselessly consumes cash.

- Stock outs and/or long lead times impacting sales – Buying only to current demand and not to forecasted demand and sales can create shortages and missed revenue opportunities.

- Uneven manufacturing capacity – Leading to long lead times and excess spending to compensate for demand spikes (this can occur by not considering seasonality of the industry or customer buying patterns).

To ensure and drive alignment across the organization on S&OP decisions, best practice says this is a formal recurring process and integrated with the financial planning process and projections.

What is the typical S&OP process?

Ideally in a manufacturing environment, this should be a regularly scheduled recurring meeting. In some cases, finance may lead the meeting as the coordinator and facilitator across the various functions.

Depending on the volatility, cycle times, size and complexity of the company, this meeting can be scheduled biweekly. If held too often, it can lose meaning and becomes repetitive; if not often enough, decisions can be missed; if not scheduled, it can lead to poor decisions.

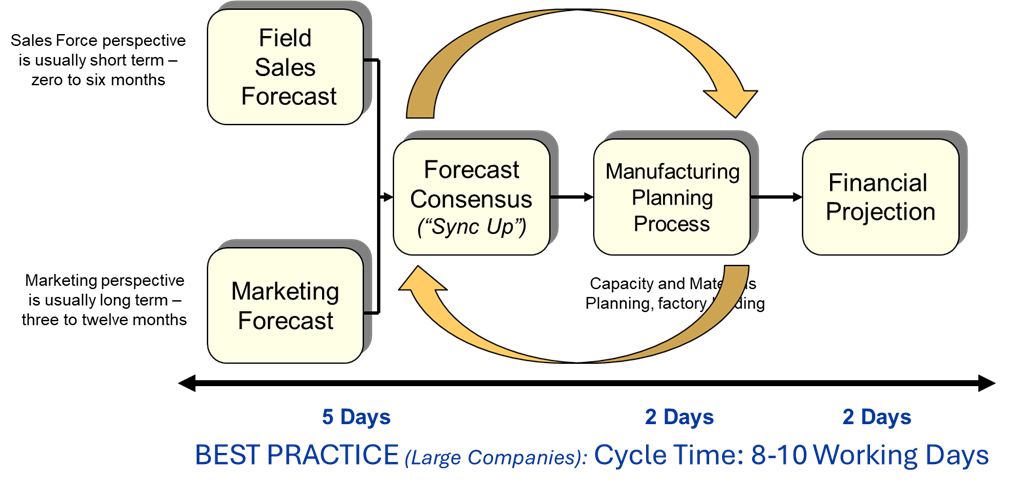

The process is a cycle. Sales and marketing provide forecast data from their various perspectives which “syncs up” into a demand forecast (what I want). This is provided to manufacturing (including purchasing) to generate material and capacity planning and a response to the demand forecast (what I can produce). There may be multiple cycles here, but eventually a consensus is reached and provided to finance to generate the financial forecast. [2]

Who makes the decisions?

Ideally, it’s a group consensus with alignment. However, it is important to have an escalation process or overall decision maker.

- Is someone in the S&OP meeting the final decision maker? OR

- What is the process to decide if and when there is an impasse? (CEO/CFO/COO, etc.)

What’s the feedback mechanism?

For the S&OP process to be most effective, there needs to be a solid feedback loop to all the constituents. Specific details need to be provided to all involved as an outcome of the process.

- Sales and marketing need to know what volume and mix of products will be available to sell.

- Purchasing and manufacturing need to know what to buy and what to build.

- Finance needs to know what will be built, what will be bought, what will be sold, and, most importantly, when, to build an attainable financial forecast and cash plan.

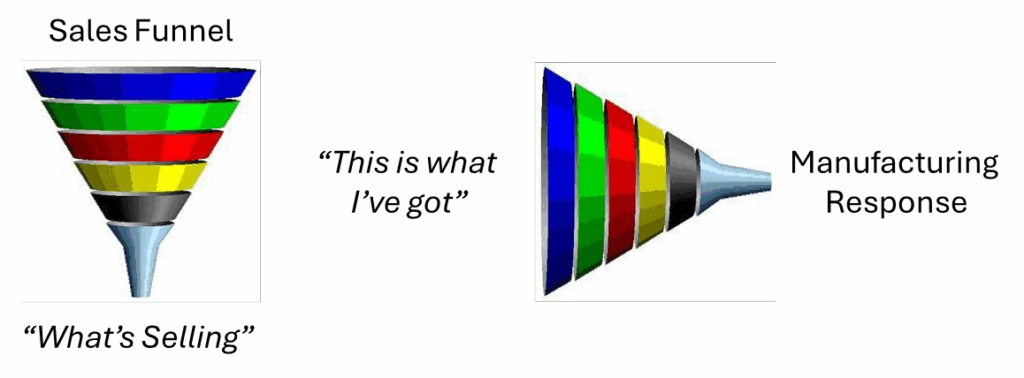

There is also a need for ongoing feedback during the ensuing period: sales communicating “what’s selling” and manufacturing providing what’s available (“what I’ve got”), turning the sales funnel into a megaphone (i.e., “I’m out of Prime Rib! Push the Meatloaf!”)

Turning the Sales Funnel Into a Megaphone [2]

What’s the bottom line?

The S&OP process works. It can be painful to start, but once it’s operating, it adds immense value to your business.

Thanks and credit to David Gavlik for his contributions and insights for the Sip Club.

David Gavlik is an operationally focused finance professional with 25+ years of financial experience in multiple products and industries (including biological products, complex hardware solutions, and storage / workspace equipment manufacturing and distribution) in companies ranging from $50-100M. https://www.linkedin.com/in/david-gavlik-7924666/

Jeff Osorio is a Consulting CFO with over 30 years of experience in operationally oriented companies ranging from pre-Revenue to $4B with over 40 ERP implementations in his portfolio. He is also an Adjunct Professor in the MBA program of the Leavey School of Business at Santa Clara University. https://www.linkedin.com/in/jeff-osorio-1412181/

[1] “Orchestrating Success”, Richard C. Ling and Walter E. Goddard, Copyright 1988 by John Wliey & Sons, Inc

[2] “Managing For Performance”, Jeff Osorio, Copyright 2024